Richard Drew/APThis photo from the New York Stock Exchange shows five years of the Dow Jones industrial average on July 3, the first time it topped 17,000.

Richard Drew/APThis photo from the New York Stock Exchange shows five years of the Dow Jones industrial average on July 3, the first time it topped 17,000.By Steve Rothwell

Stocks delivered again in 2014. Even after a poor start in January and wobbles in October and December, the U.S. market climbed 11.4 percent and ended the year close to record levels. The solid gain pushed the bull run for stocks into its sixth year, the longest such streak since the 1990s.

Investors have been encouraged by rising corporate earnings and a strengthening U.S. economy, which helped stocks overcome a brief winter chill in growth and tensions with Russia. The stock marke! t also overcame worries about the impact of the end of the Fed! eral Reserve's stimulus program.

Those who stuck out the market's ups and downs were rewarded with double-digit returns for the fifth year out of the last six. "Companies delivered and the ability to produce on the bottom line remained resilient," said Jeff Kleintop, Charles Schwab's chief global investment strategist. "Ultimately, that's what stocks track."

All the major stock averages are ending the year with respectable returns. The Standard & Poor's 500 index (^GPSC) has returned 13.7 percent including dividends, after a return of 32 percent in 2013. The stock market also experienced its biggest bout of volatility in more than two years. Stocks plunged as much as 9.8 percent in October on concerns about global growth and worries about the spread of the Ebola virus.

The market also managed to climb despite a big drop in oil prices that hit energy companies. Geopolitical tensions flared as Russia seized Crimea, war broke out in ea! stern Ukraine and the Islamic State group seized swaths of territory in Iraq and Syria. These were some of the biggest themes in the financial markets in 2014:

A Resilient Economy

The backdrop for the stock market's gains was a gradually strengthening U.S. economy. Hiring and consumer confidence continued to improve. Despite a big contraction in the first quarter caused by an unusually harsh winter, the economy kept growing. The average pace of growth climbed to 2.7 percent by the end of the year, up from 2.3 percent a year earlier.

Don't Count Out Bonds

A widely forecast demise for bonds failed to materialize. Bonds had been expected to slump as the Fed neared the end of its bond-buying stimulus program and economic growth accelerated. Instead, they rallied as investors became more pessimistic on the outlook for global growth as economies overseas weakened.

Bonds also gained because they looked attractive to o! verseas investors. Their yields, while close to historically low levels! , are still higher than in countries like Germany and Japan. The yield on the 10-year Treasury note ended the year at 2.17 percent, after starting 2014 at 3 percent. The Barclays Aggregate Index, which measures the performance of a broad range of bonds, returned 5.9 percent, its best year in three.

Still Looking for Income

The biggest beneficiaries of lower bond yields were companies that pay rich dividends as investors looked to them as an alternative source of income. "Investors still want bond-like returns," said Krishna Memani, chief investment officer of OppenheimerFunds. So "the more bond-like parts of the equity market have done quite well."

Those sectors included utilities and real estate investment trusts. The utilities sector is the year with a gain of 24 percent, the best performance of the 10 sectors that make up the S&P 500 index. Utility companies in the index have an average dividend yield of 3.4 percent. U.S. REITs pay abou! t 3.6 percent.

Deal Revival

It was also a good year for deal-making. The value of global mergers and acquisitions rose to the highest point since 2007, while the number of initial public offerings was the highest since the technology bubble days of 2000.

Among the notable tie-ups announced were Actavis' (ACT) agreement to buy fellow drugmaker Allergan (AGN) for $66 billion in November, and Comcast's (CMCSA) deal to buy Time Warner Cable (TWC) for $45.2 billion in February.

In IPOs, China's e-commerce giant Alibaba (BABA) raised $25 billion in its stock market debut in September, making it the biggest U.S.-listed IPO in history. Strong demand for the stock sent the market value of the company beyond that of Amazon (AMZN), eBay (EBAY) and Facebook (FB).

Keep the Growth Coming

U.S. companies, benefiting from low interest rates and a gradually improving economy, have become adept at driving their profits high! er since the recession. Those rising earnings are underpinning the rall! y in stocks.

Earnings at S&P 500 companies are projected to reach a record of $116.97 per share for 2014, an increase of almost 8 percent from a year earlier, according to S&P Capital IQ.

"If you look at the cash flow and profitability of companies today, especially in the U.S., it is just darn impressive," said Seth Masters, chief investment officer for Bernstein Global Wealth Management.

Cheap Oil Isn't All Good News

Fears of weak growth overseas and worries of a supply glut combined to push oil down 50 percent in six months. After trading at a peak of $107 a barrel in June, oil ended the year at $53.27.

Falling oil prices lead to lower gas prices, which is a good thing for consumers. But there are also losers when crude slumps. Energy stocks, which account for about 10 percent of company earnings in the S&P 500 index, plunged.

As the losses in oil accelerated this fall, investors also worried about the wider implicatio! ns. If prices stay low, some producers could go out of business, costing workers their jobs and prompting defaults in the bond market. The fall in oil also created the year's biggest winners and losers.

Transocean, a provider of offshore drilling services to the energy industry, was the year's biggest loser among S&P 500 stocks as demand for its services was expected to fall. The stock price slumped 63 percent. Airlines, which are heavy users of fuel, were big beneficiaries of the slump. Southwest Airlines' stock has climbed 125 percent, the biggest gain in the S&P 500.

Central Banks Go in Opposite Directions

The Fed ended its bond purchases in October and is inching closer to its first rate increase since 2006. At the same time, other central banks around the world started to introduce more stimulus as growth in their regions slowed.

The Bank of Japan stepped up its efforts to revive that country's economy, as did the European Centr! al Bank. China also lowered a key interest rate.

Investors debate! d whether the U.S. will pull the rest of the world up, or be dragged down by it.

Stocks Aren't Cheap Anymore

After big gains in recent years, stocks are no longer a bargain. At the same time, they haven't yet reached vertiginous levels that would keep investors up at night.

The average price-earnings ratio for S&P 500 companies, which measures the price of a stock against the company's expected earnings over the next 12 months, climbed to 16.5, from 15.3 at the start of the year. That's above the 10-year average of about 15, according to FactSet data, but still a long way off from the levels seen during the technology boom fifteen years ago, when the average ratio was as a high as 27.

The slight rise in valuations suggests that investors have moved from being skeptical to being "pragmatically optimistic," said Anastasia Amoroso, global market strategist for J.P. Morgan Funds.

Source : http://www.dailyfinance.com/2015/01/01/bull-market-keeps-going-2014/

Tim Boyle/Bloomberg/Getty Images By Michelle R. Smith

Tim Boyle/Bloomberg/Getty Images By Michelle R. Smith Nivea Cabrera/AP Hasbro, the Pawtucket-based toy company, is now doing damage control over the extruder tool in its Play-Doh Cake Mountain toy. The two-piece syringe-like tool, which includes a tube with corkscrew-type ridges around the outside and a dome-shaped top with a hole at the tip, can be used to squeeze Play-Doh to look like decorative cake frosting.

Nivea Cabrera/AP Hasbro, the Pawtucket-based toy company, is now doing damage control over the extruder tool in its Play-Doh Cake Mountain toy. The two-piece syringe-like tool, which includes a tube with corkscrew-type ridges around the outside and a dome-shaped top with a hole at the tip, can be used to squeeze Play-Doh to look like decorative cake frosting. Richard Drew/APThis photo from the New York Stock Exchange shows five years of the Dow Jones industrial average on July 3, the first time it topped 17,000.

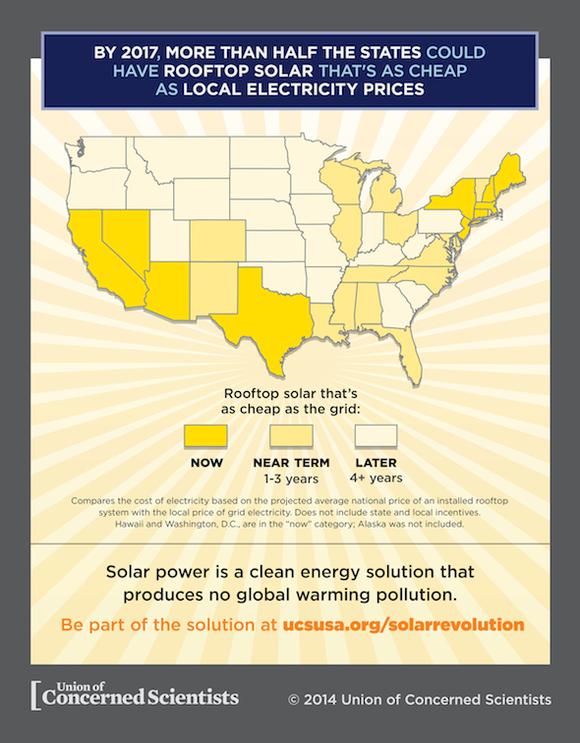

Richard Drew/APThis photo from the New York Stock Exchange shows five years of the Dow Jones industrial average on July 3, the first time it topped 17,000. Lester Lefkowitz Whether you realize it or not, solar energy is becoming a more and more important part of our energy future. In 2013, 29 percent of new electricity-generating capacity in the U.S. was solar energy, and so far in 2014, 36 percent of new capacity is solar.

Lester Lefkowitz Whether you realize it or not, solar energy is becoming a more and more important part of our energy future. In 2013, 29 percent of new electricity-generating capacity in the U.S. was solar energy, and so far in 2014, 36 percent of new capacity is solar. Union of Concerned Scientists

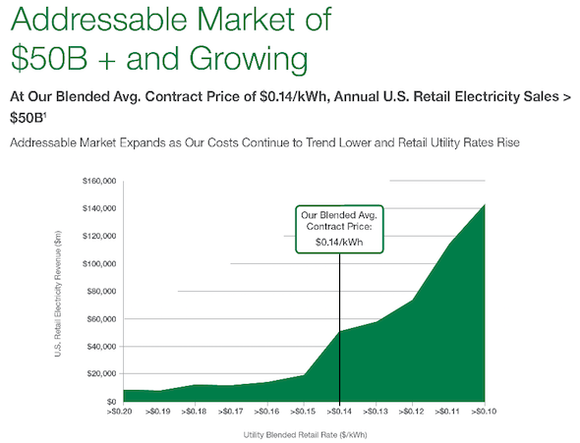

Union of Concerned Scientists SolarCity

SolarCity Seth Wenig/AP By Ken Sweet

Seth Wenig/AP By Ken Sweet